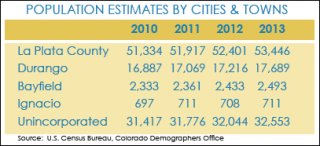

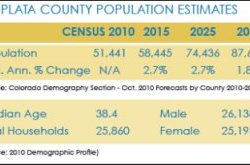

The Colorado condition Demography part provides annual populace estimates, that quotes are constantly revised centered on a number of factors.

The Colorado condition Demography part provides annual populace estimates, that quotes are constantly revised centered on a number of factors.

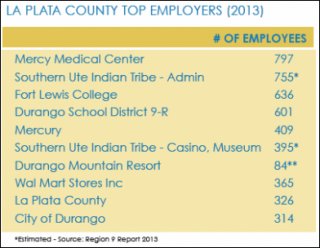

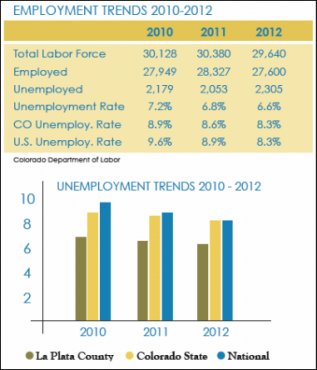

The region’s biggest businesses feature education, medical services, government, retail grocers and tourism. Employment is assessed in many ways eg yearly payroll, amount of staff members, plus full time equivalent (FTE) staff members.

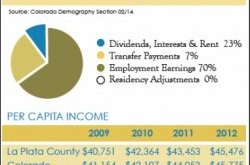

Complete private Income in the county is more than entirely employment earnings. Totals consist of various other resources streaming in to the county eg transfer payments, dividends, interest and lease, and residency corrections.

FeesState Income Tax taxation rate is 4.63per cent of nonexempt income.

Product sales & utilize taxation Tax totals 7.9percent and is composed of 2.9% condition, 2per cent county and 3.0percent town. Within the Durango business Zone, the purchase of gear and machines or resources utilized solely for production in zone tend to be exempt from the 2.9% state product sales/use income tax.

Product sales & utilize taxation Tax totals 7.9percent and is composed of 2.9% condition, 2per cent county and 3.0percent town. Within the Durango business Zone, the purchase of gear and machines or resources utilized solely for production in zone tend to be exempt from the 2.9% state product sales/use income tax.

Lodger's taxation a tax of 2percent is gathered on all lodging properties within the county and city.

Property taxation Property is examined at 29percent of real value for commercial and commercial at 9.74% for residential. La Plata County income tax information.

Property taxation Property is examined at 29percent of real value for commercial and commercial at 9.74% for residential. La Plata County income tax information.

Worker's payment changes centered on professions within procedure. Self-insurance is permitted in Colorado.

YOU MIGHT ALSO LIKE